Rate of Mark-up on State Provident Fund (GP Fund) for Fiscal Year 2023-2024

Introduction

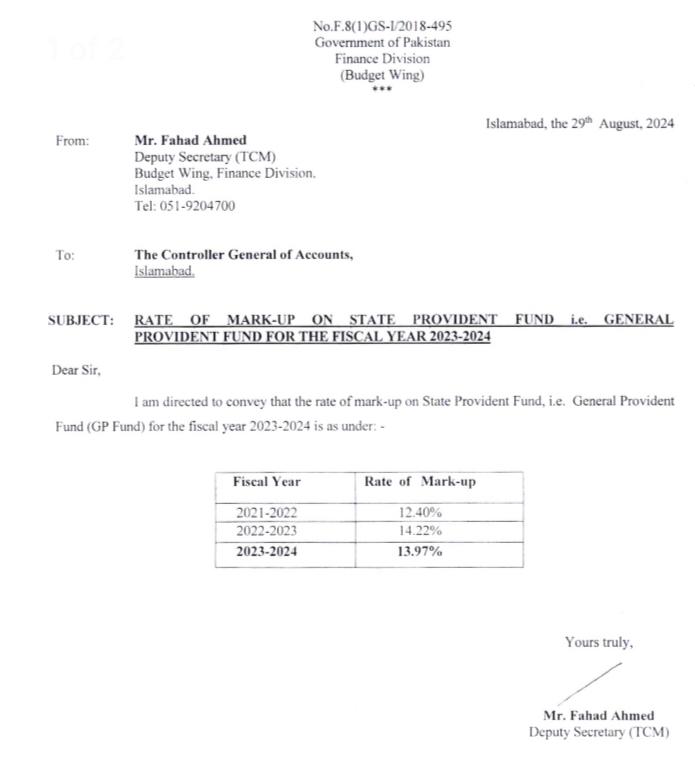

The Government of Pakistan, Finance Division (Budget Wing), has announced the rate of mark-up on State Provident Fund (GP Fund) for the fiscal year 2023-2024. This article provides a detailed overview of the announced rate and its implications for GP Fund holders.

Rate of Mark-up for Fiscal Year 2023-2024

The rate of mark-up on GP Fund for the fiscal year 2023-2024 has been set at 13.97%. This is a slight decrease from the previous year’s rate of 14.22%.

Comparison of Rates for Previous Years

| Fiscal Year | Rate of Mark-up |

|---|---|

| 2021-2022 | 12.40% |

| 2022-2023 | 14.22% |

| 2023-2024 | 13.97% |

Implications for GP Fund Holders

The announcement of the mark-up rate has significant implications for GP Fund holders:

- Increased Returns: The higher mark-up rate will result in increased returns for GP Fund holders.

- Enhanced Savings: The attractive rate may encourage more individuals to contribute to the GP Fund.

- Financial Security: The GP Fund can be a valuable tool for financial security and retirement planning.

FAQs

- What is GP Fund? GP Fund is a government-sponsored retirement savings scheme.

- How is the mark-up rate determined? The mark-up rate is determined by the Government of Pakistan based on various economic factors.

- When is the mark-up credited to GP Fund accounts? The mark-up is typically credited to GP Fund accounts annually.

- Can I withdraw my GP Fund before retirement? Yes, but there are certain conditions and restrictions that apply.

Conclusion

The announcement of the mark-up rate on GP Fund for the fiscal year 2023-2024 is a positive development for GP Fund holders. The increased rate will provide a boost to their savings and retirement planning. It is important for GP Fund holders to be aware of the rate and its implications to make informed decisions about their financial future.