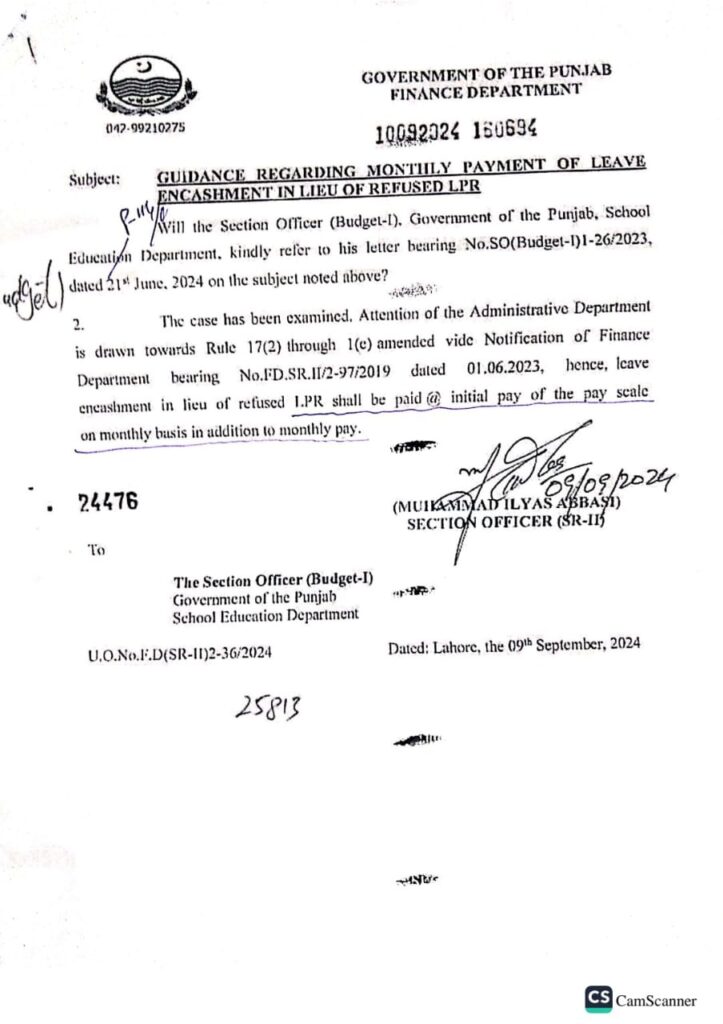

Guidance Regarding Monthly Payment of Leave Encashment in Lieu of Refused LPR

Introduction

This article provides a comprehensive overview of the guidelines issued by the Government of the Punjab, Finance Department, regarding the monthly payment of leave encashment in lieu of refused LPR (Leave Preparatory Relief). The guidelines are outlined in the U.O.No.F.D(SR-11)2-36/2024, dated Lahore, the 09th September, 2024.

Key Points

- Applicable Rule: The guidelines are based on Rule 17(2) through 1(e) of the relevant rules, as amended vide Notification of Finance Department bearing No.FD.SR.II/2-97/2019 dated 01.06.2023.

- Monthly Payment: Leave encashment in lieu of refused LPR shall be paid @ initial pay of the pay scale on a monthly basis, in addition to monthly pay.

- Administrative Department Responsibility: The Administrative Department is responsible for ensuring compliance with these guidelines.

FAQs

Q1: What is LPR?

A1: LPR stands for Leave Preparatory Relief. It is a financial benefit provided to government employees to cover their expenses during the period of leave.

Q2: When is LPR refused?

A2: LPR may be refused in certain circumstances, such as when the employee fails to meet the required conditions or when the leave is not approved.

Q3: How is leave encashment calculated?

A3: Leave encashment is calculated based on the employee’s initial pay and the number of days of leave encashed.

Q4: Is leave encashment in lieu of refused LPR paid in a lump sum?

A4: No, leave encashment in lieu of refused LPR shall be paid on a monthly basis, in addition to monthly pay.

Conclusion

The Government of the Punjab, Finance Department, has issued clear guidelines regarding the monthly payment of leave encashment in lieu of refused LPR. These guidelines are intended to ensure that government employees receive the benefits they are entitled to.